As of 2025, mobile banking apps are used by more than 3.6 billion people, which means nearly 40% of people are relying on mobile banking apps to manage their money. This rapid increase in digital payments has pushed the traditional banks to innovate, and mobile banking app development has become an important area of focus.

From AI-powered financial insights to virtual debit cards, banking apps have undergone rapid expansion. In this blog, we will explore the following,

- The current trends in mobile banking

- Types of mobile banking solutions

- A step-by-step development guide

- Key features and benefits of launching a mobile banking app.

Let’s begin!

What is Mobile Banking?

Mobile banking refers to the process of accessing financial services offered by a bank or any other financial institution right from a smartphone or tablet. This includes a wide range of tasks like,

- Checking account balances

- Transferring funds

- Paying bills

- Applying for loans

- Managing credit cards

What makes mobile banking unique is its ability to offer round-the-clock financial access, unlike traditional banks that operate only on fixed hours.

Types of Mobile Banking Apps

The mobile banking services are majorly classified into three types, each differs with the smartphone usage and internet availability.

1. Mobile Banking via Mobile Apps

This is the most common form of mobile banking. Where customers can download their bank’s official app on their smartphones and can access different services. The key functions include,

- View account balances, transaction histories

- Fund transfers

- Fixed deposits and mutual funds

- A customer support system to address queries

Banks like Monzo and HDFC offer advanced mobile apps that effectively combine both banking and financial planning tools!

2. Mobile Banking via SMS

It is specifically designed for users without internet access or smartphones. So, through SMS, they can access certain services by sending a predefined text command to the bank’s code.

Services include,

- Checking account balance

- Mini statements

- Blocking lost debit or credit cards

- Checking interest or forex rates

- Transferring funds between linked accounts

For example, users can send “BAL” to a bank’s number, and then they can view their account balance.

3. Mobile Banking via USSD

USSD is a session-based service that works on any GSM phone, which doesn’t require any internet at all. Say, for example, in India, 99# is a widely used USSD service which allows users to,

- Check balances

- View mini statements

- Transfer funds through the account number

- Access services in multiple languages

USSD-based banking is fast and is easily accessible to millions of users who don’t own a smartphone.

Benefits of Developing a Mobile Banking App for Businesses

Building a mobile banking app offers several attractive benefits. It enables banks to offer a digital innovation to their users. Let us see what are the upsides of developing one.

Improved Customer Engagement & Loyalty

The main aim of mobile banking apps is to offer 24/7 banking services that allow users to access the services at any time without any limitation. With personalized alerts and notifications, users can always stay informed about updates and other information. Thus offering a high level of user engagement.

Reduced Operational Costs

Mobile apps help save costs involved in maintaining a physical branch, which includes,

- Staffing

- Paperwork

- Infrastructure

Paperless Operations

Mobile banking apps effectively eliminate the need for paperwork, with the help of digital onboarding and e-statements. This helps users access their required service quickly and with ease.

Streamlined Business Operations

Several features speed up the operations for both users and banks, like,

- Real-time fund transfers

- Automated bill payments

- Digital KYC verification

Data-Driven Personalization

Mobile banking apps offer valuable user behaviour insights, which allow banks to customize their functionalities and upgrade the platform according to user needs.

Increased Cross-Selling Opportunities

By tracking user behaviour, the apps allow for various cross-selling opportunities for

- Credit cards

- Insurance

- Loans and

- Financial products

Wider Customer Base Through Digital Channels

Mobile-first approach is very effective in reaching tech-savvy users and those who are in remote areas and find it difficult to visit a physical bank. And this helps in expanding the market presence.

Enhanced Security & Trust

The mobile banking app comes with advanced security measures like suspicious login tracker, real-time fraud alerts, and other protocols that help gain trust among users!

Step-by-Step Mobile Banking App Development Guide

Developing a Mobile banking app involves several key steps. Each step must be carried forward with utmost focus to launch a successful mobile banking app. Have a look at the steps involved,

Step 1: Market Analysis

First, begin by analyzing the market and the top players. This helps you decide upon your target niche and identify market gaps. Ultimately, you can frame your unique value proposition based on this. This step is like the foundation for your development journey, where the business goals are drafted.

Step 2: Create a Product Roadmap

This step involves outlining how your app should be. This includes deciding the key features, other functionalities, development timeline, and much more. A well-structured roadmap helps you navigate the development process without any confusion.

Step 3: Conceptualization

Here you will turn your business objectives into workflows, like onboarding and transaction processes. And this involves UX designers and developers to validate the functionalities and plan accordingly.

Step 4: Wireframing and Design

The first thing your users will see upon entering the platform is the interface, so make sure the design is super simple and can be easily accessed by users. Better aim for a clean and intuitive user interface.

Step 5: Choose the Right Technology Stack

Selecting the right technology stack is very important, as it directly affects the budget and timeline of development. There are a few common tech stacks like React Native, Node.js or Java, and much more. Select the one after doing proper market research.

Step 6: Feature Selection

Choose the core features of your platform, like KYC, fund transfers, or transaction history, and others. In case your idea is to launch with an MVP that has only basic features, then you can integrate advanced features once your business grows.

Step 7: Development and Integration

You can talk with your development partner and go with Agile methodology, as this involves dividing the development process into fragments and completing it one by one. And while developing each component, it is advised to have proper documentation.

Step 8: Ensure Security & Compliance

Implement advanced security measures like,

- Biometric login

- Session timeout

- Multifactor authentication

- DDoS protection and so on

Due to the involvement of money, you cannot compromise security protocols to ensure your users’ funds are safeguarded in the right manner.

Step 9: Quality Assurance and Testing

Upon completion of testing, it is time to conduct rigorous testing. This helps identify vulnerabilities and bugs in the initial stage itself. And it can be fixed before the mobile banking app hits the end users.

Step 10: Launch and Deployment

Once done with testing, the app is all set to be deployed in the Apple App Store or Google Play Store. It is advised to monitor user feedback promptly and ensure the backend systems are scalable.

Step 11: Post-Launch Support and Updates

Your work doesn’t end with just launching the app. To be honest, the real work starts after the launch. You will monitor its performance and resolve bugs, if any, along with regular updates and maintenance.

Key Challenges of Developing a Mobile Banking App

Even though mobile banking apps offer several benefits, it does come with a few challenges as well!

Regulatory Compliance

Every country has its financial regulations. So, staying compliant across jurisdictions is very important to ensure a smooth experience for your users.

Security Protocols and Data Protection

Banking apps are constantly the primary targets for cyberattacks, and now and then we come across news stating about these money thefts. To avoid such things, it is very important to implement advanced security measures like,

- End-to-end encryption

- Session handling

- Multi-factor authentication

- Fraud detection

Integration with Legacy Banking Systems

Most of the traditional banks have outdated core systems. And integrating modern mobile apps with these systems is complex, to offer quality service to the users.

Keeping Up with Technology Trends

Technology keeps improving day by day with innovations. And with the entry of AI, it is really taking things fast. So, it is advised to make sure the system of your platform can adapt quickly to the new tech without much complexity.

Balancing Innovation with Practicality

Adding several features to your banking app can complicate the user interface and can even push up the development timeline. Developers must prioritize core features along with a good amount of usability, and can focus on other functionalities later.

Maintaining User Trust

Data breaches not only cause personal loss to the users but also can damage the bank’s reputation. Ensuring the app’s transparency and security is of utmost importance to build trust among users.

Usability Across Devices

Users expect seamless performance across various devices, no matter whether it is Android or iOS. So, designing user-friendly and responsive interfaces that have minimal bugs is a challenging task.

Scalability

As user number grows, the app must be ready to adapt to such change and must offer a smooth experience to the users without facing any downtime. Building an app that is both scalable and can offer first-class quality is quite complex.

Factors Affecting the Cost to Develop a Mobile Banking App

UI/UX Design – A modern and easy-to-use interface might require more time resources, which increases overall costs.

App Platform – Developing individual apps for both Android and iOS impacts the budget. And going with cross-platform apps can significantly reduce the cost.

Team Size – A large team with specialists can deliver the app quickly, but it increases the expenses.

Technology Integration – Choosing advanced tech like artificial intelligence or blockchain integration can raise the cost due to the complexity involved.

Security Features – Security is of utmost importance, and in case you are very much concerned about offering high-quality security measures, then it will add extra development cost.

Compliance Requirements – Staying compliant with various regulations is very crucial, and it might demand legal experts to assist you in this process, which comes as an added cost.

Testing and QA – Conducting extensive testing is important to learn about its performance and usability. However, it adds extra costs.

Essential Features of a Mobile Banking App

Intuitive User Interface

A clean and clear user interface is much needed as it caters to the needs of all levels of users, from beginners to well-versed users. This allows them to quickly find out the banking service they are looking for without any difficulty.

Account Management

This allows users to check their account balances, view statements, and track transactions effectively.

KYC Verification

This verifies users' identities to securely onboard new users right from the mobile app itself. And it also prevents unauthorized access.

QR Payments

Users can easily scan the QR codes using QR support and make instant payments.

Fund Transfers

Both domestic as well as international money transfers are made easy right from the mobile app itself.

Transaction History

The app stores detailed logs about past transactions, which helps users to review their spending and make budgeting plans.

Loan & Credit Features

Users can apply for loans or credit cards all by themselves without any paperwork with the help of the mobile banking app.

Customer Support

Users' queries are effectively resolved with the help of in-app support through live chat and a ticketing system.

Authentication

With the help of secure login options like 2FA, it acts as an additional layer of security that ensures only authorized users can access the account.

Bill Payments & Scheduling

Users can set reminders for paying bills or due, or interest for the loans they have taken up.

Transaction Management

With transaction management, users can track and have a complete picture of their spending. This helps them find out strategies to control expenses.

Security & Compliance

Users' data is protected through advanced security measures that prevent fraud and keep data breaches and thefts at bay.

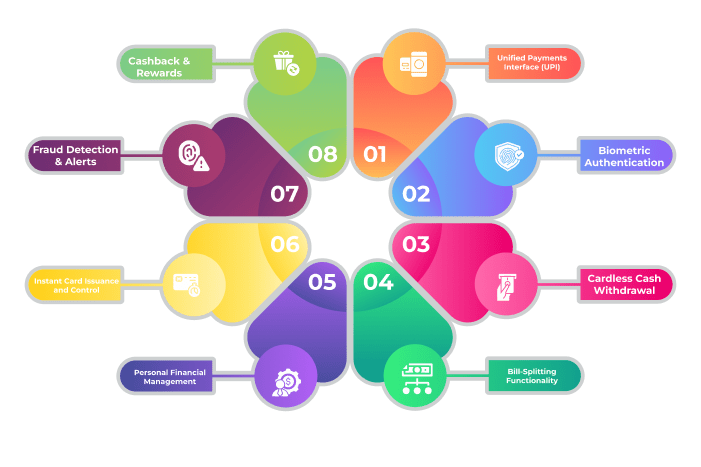

Advanced Features of a Mobile Banking App

Unified Payments Interface (UPI)

This allows users to make seamless and instant transfers directly between bank accounts with the help of a UPI ID.

Biometric Authentication

Users are offered secure logins through fingerprints and facial recognition.

Cardless Cash Withdrawal

Users can make ATM withdrawals simply using the app without the need for a physical card.

Bill-Splitting Functionality

Payments can be split among friends and family, and can make individual payments instantly.

Personal Financial Management

The mobile banking app allows users to track their spending for each month and set savings goals and budgets efficiently.

Instant Card Issuance and Control

Users can complete their KYC verifications and generate virtual cards instantly, which they can use to make payments.

Fraud Detection & Alerts

With the help of fraud detection, users can monitor their account logins and transactions. And in case of any suspicious activity, instant alerts are sent to them via SMS or email.

Cashback & Rewards

For certain transactions, users are offered cashback and loyalty points. This acts as an attractive feature to increase loyal users.

Mobile Banking App Development with Emerging Features

Personalized Offers

AI can be used to study users’ preferences and spending patterns and can suggest to them loan offers or other investment plans.

Modern & Intuitive UX/UI

Focuses on offering a visually appealing user interface that works seamlessly across all devices, thus allowing users to access the financial services on the go.

Virtual Cards

Users can generate secure virtual cards online, which allows them to make contactless payments, thus eliminating the risk of card theft.

Integration with Wearable Devices

Users are offered the convenience to check balances, receive notifications, and receive alerts directly from their smartwatches or other personal devices.

AI Chatbot

This offers 24/7 support for users, where their queries are resolved quickly and they are offered the required guidance to navigate the platform or to access certain services.

Expense Trackers

Users can track their expenses clearly and draw a conclusion on where their money goes, where they spend the most, so that they can cut down unnecessary costs.

Budgeting Tools

With the help of advanced budgeting tools, users can set a savings target and get reminders to move an amount of money to that slot to ensure regular savings.

AI-Powered Financial Health Monitor

This effectively analyzes income, spending, and offers personalized tips to improve financial stability and savings goals.

Gamified Financial Goals

With leaderboards, games, and rewards, users are motivated to save and budget better in each passing month.

On-Demand Financial Coaching

Users are connected with certified financial advisors for real-time tips and advice to manage their finances better within the app.

End Note

Mobile banking app development is no longer just about making transactions simple and easy. It is way more than what we think. It offers personalized banking experiences that match new-age customers. Which outstanding features like AI-driven insights, real-time notifications on mobile phones and smart watches, and gamified savings. Banks can boost user engagement and improve loyalty!

Frequently Asked Questions

1. How long does it take to develop a mobile banking app?

The time taken to develop a mobile banking app depends on various factors like,

- Complexity

- Features and

- Compliance requirements

2. Which technologies are used for mobile banking app development?

The common tech stacks used for mobile banking app development are,

- Java/Kotlin for Android

- Swift for iOS

And frameworks like React Native are widely used for cross-platform apps, along with other APIs.

3. How do you ensure security in a mobile banking app?

Security in a mobile banking app can be ensured by implementing several security protocols, like

- Multi-factor authentication

- End-to-end encryption

- Biometric login and much more

Along with regular security audits to protect user data from fraudulent activities.

4. What’s the average cost to develop a mobile banking app?

Just like the timeline, the cost to develop a mobile banking app ranges between $50,000- $150,000, and it varies with features integrated and other factors.

5. Can a mobile banking app support cryptocurrency transactions?

Yes, of course, it can be supported by integrating blockchain and crypto wallets. These mobile banking apps can enable the secure buying and selling of crypto assets.