Table of Content

- Services

- Blockchain

- Solutions

Exchange Development

Banking & Fintech

Wallet

Trading Bots

DEFI

NFT

Game Development

- Blog

- Company

- Get in Touch

Table of Content

Crypto moves extremely fast, just like the Parker Solar Probe rocket. Because it is not the human traders who are competing, it is the bots! And among the widely used bots, front-running bots are most profitable. These automated assistants closely watch pending transactions to spot profitable trades. If they find one, then they would jump ahead of them and end up making a profit from the price inefficiencies.

The numbers here are not at all a joke. Because reports state that front-running and MEV bots are literally making hundreds of millions of dollars from crypto exchanges. These bots are brilliant enough to reap such huge profits!

In this guide, we will jump into front-running bots and cover aspects like,

Without further delay, let us get started!

So, basically, front running means getting ahead of someone else’s trade, once you know that it is about to happen. In traditional finance, brokers are the one who places their own trades first, because they have early access to customer orders.

But, in crypto, this system is quite upgraded, and all the blockchain transactions, before they are confirmed, are moved to a waiting hall called the Mempool. And these bots would keep an eye closely on this mempool and conduct their own transaction first. And to execute the transaction before others and that too quickly, they would probably pay a higher gas fee, and yes indeed, this is their strategy!

Now, let us understand this well with an example. Imagine a case where a trader submits a swap on Uniswap to buy a token that is worth around $50,000. This front-running bot would spot the pending order, as it finds it to be a huge trade, then it quickly buys first, and then sells it immediately after the trader’s transaction. So, what is the result of this? The trader ultimately ends up paying more, and the bot earns a profit with this price difference.

Front-running bots depend on speed and visibility. Their whole workflow revolves around spotting profit-making opportunities before the transactions get confirmed.

Let us see how it actually works

Front-running bots use different strategies to exploit the target trade. The three most common attack types are,

Let us view each of them in detail.

In the displacement attack, the bot replaces the targeted users’ transactions by getting in first! The targeted users’ trade happens next, but since the bot has submitted the buy order before the victim’s large swap, it takes up the better price. And when the victim’s order executes, it pushes the price higher, and the bot sells for profit!

This is called the “Classic Sandwich Attack”. Here, the bot sandwiches the victim’s trade between two of its own, so first the bot buys before the victim, and then the victim’s trade moves upward. Finally, the bot sells right after this, and profits from the spread!

In this suppression method, instead of profiting from the price movement, the bot either prevents or delays the victim’s trade by spamming the mempool with higher gas fees. This allows the attackers to,

Each of these methods is used in different scenarios! For example, insertion attacks are very harmful to everyday users. Meanwhile, displacement and suppression attacks often target large trades.

Even though speed is the crucial aspect in front-running bots, it is actually more than that. It is a combination of several features that work together to execute profitable trades.

A good bot must scan the mempool in real time. So, every second counts because there are plenty of other bots that are competing for the same profit-making opportunity. Even a small delay would lead to lost profits.

Bots require direct access to the mempool, as it is the place where they can view the pending transactions. So, for this, some developers might use private node providers for low-latency access to gain a competitive edge over other bots.

Since front-running involves jumping ahead of the line, these bots need advanced and robust logic to set a higher gas fee to win priority. This optimization determines whether a trade would be profitable or not.

Once an opportunity is detected, the bot must automatically execute trades. This even includes the smart contract interaction with DEXs like SushiSwap and PancakeSwap.

Front running can be risky at times, but bots need built-in risk management tools for activities like,

Front-running is risky. Bots need built-in checks to avoid unprofitable trades, handle failed transactions, and prevent getting trapped by other bots (known as counter-sandwiching). Good risk controls protect profits and reduce unnecessary gas spending.

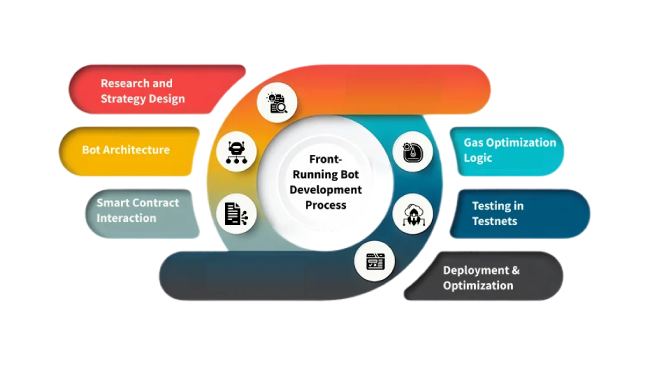

Creating a front-running bot is more than just coding. It is about crafting a system that can survive an extremely competitive landscape. The development process usually consists of several steps. Have a look at it.

Before writing any code, developers must analyze and understand how different DEX platforms work. Understanding its mempool structures would help design a trading strategy. Here, the goal is to define when the bot should act and how to make a profit out of it.

Upon analyzing, the next step is to structure the bot, which involves building,

A good architecture makes the bot easier to adapt and upgrade to changing conditions.

The bot must interact without any difficulty with the DeFi smart contracts. So this requires coding the bot to handle the pool mechanics more efficiently in a safe manner.

Front-running demands heavy gas fees. Developers build algorithms to optimize the gas fees. But it involves complexity, as if the gas fees are too high, then profits could vanish, and if it is too low, then the bot might lose the race!

Once done with the development process, the bots must be tested in environments like testnets and sandboxes. This helps in identifying issues in the initial stage itself and fixing them before they hit the end users.

Upon rigorous testing, the bot is all set to be deployed on the mainnet. Still, continuous monitoring is essential to keep your bot competitive in the market

Even though running bots is profitable, they do come with a few serious risks, which traders must consider before leveraging them.

At times, hundreds and dozens of bots compete for the same profitable opportunity. But the winning depends on factors like,

Even a small delay can turn a profitable opportunity into a huge loss!

Front-running bots always seem to be controversial. Some argue it to be simply market efficiency, while others find it to be harmful for ordinary traders. In certain jurisdictions, these practices are termed illegal in the traditional financial space, which poses a severe threat to front running.

Failed transactions

If gas fees are miscalculated, then the bot might lose money. But the target trade would still go through.

Counter-Bot Strategies

You are not the only bot user! Several other bots are competing against each other, which can end up in “Bot wars”.

Network Congestion

During peak activity times, the gas fees can be too high, and this can make the profits vanish!

While front-running bots promise to provide big profits, they also might push users into financial losses and other risks. So, traders must be careful about these factors.

Yes, of course, bots are tough opponents, but traders can make use of several techniques to reduce the chances of being attacked by front-running bots. Let us view what it is!

Tools like Flashbots or MEV protected relays enable traders to send transactions privately, without going through the mempool. Since bots can't see these orders, they can jump before yours!

On DEXs like Uniswap, traders set the slippage tolerance. Keeping the slippage low makes it harder for bots to exploit prices. However, setting it too low may sometimes cause traders to fail.

Bots often detect large trades. Breaking such huge ones into smaller chunks and executing them at varied intervals and time frames is one good strategy, as it makes it really hard for bots to target them!

Front-running bots are evolving along with DeFi, and their future is also tied closely to it!

Front running was one of the earliest forms of MEV, but the ecosystem is expanding constantly. We could already see that bots are becoming smarter day by day. And not just on speed, but on various strategies.

As regulators pay more attention to DeFi, front-running bots might not stay the same! It keeps evolving. If rules are similar to those in traditional finance, then running such bots could become illegal in certain locations.

Front-running bots are very controversial, and they continue to be controversial in the upcoming days as well. And there would be debates on,

Some claim it to be useful, while some argue it is inevitable and need not be banned.

The future bot development field is more likely to focus on offering greater efficiency through AI-driven decision-making and personalized suggestions. Integration with MEV or flashbots

Front-running bots are both fascinating and controversial!

In this blog, we have covered front-running bots from A-Z. If you are interested and looking forward to developing one, then partnering with Fourchain, a leading crypto trading bot development company, is the right move! From requirement gathering to post-launch support, we will be there with you throughout this journey. Take the first step by contacting our experts today.

Connect With Us Now

Drop us a line through the form below and we'll get back to you as soon as possible