Table of Content

- Services

- Blockchain

- Solutions

Exchange Development

Banking & Fintech

Wallet

Trading Bots

DEFI

NFT

Game Development

- Blog

- Company

- Get in Touch

Table of Content

Liquidity is the engine that keeps cryptocurrency markets running smoothly, enabling traders to buy and sell assets quickly and at fair prices without causing major price swings.

In today’s fast-evolving crypto landscape, liquidity isn’t just a technical detail, it’s a critical factor that impacts trading efficiency, market stability, and overall investor confidence.

Whether you’re running a crypto exchange, managing institutional funds, or launching a new token project, choosing the right liquidity provider can make all the difference.

In this guide, we’ll reveal the top crypto liquidity providers of 2025 and explore what sets them apart. By understanding their strengths, you’ll be better equipped to enhance your trading strategies, reduce costs, and stay ahead in this dynamic market!

Keep reading to discover who’s leading the way, and why it matters for your next crypto move.

Centralized liquidity providers (CLPs) operate on exchanges like Coinbase or Binance, managing large reserves to facilitate fast, deep trades. They offer high liquidity but are controlled by a single entity.

Decentralized liquidity providers (DLPs), on the other hand, operate on DEXs like Uniswap, where anyone can contribute tokens to liquidity pools, offering transparency and user control but often with lower liquidity depth.

Liquidity providers play a pivotal role in stabilizing crypto markets. By continuously offering buy and sell orders, they ensure that traders can execute transactions quickly and at prices close to market value, reducing slippage and volatility.

Their presence absorbs excess supply or demand, preventing sudden price swings and fostering a more predictable trading environment. This attracts more participants, enhances market depth, and ultimately leads to a more efficient and robust marketplace.

While liquidity providers and market makers are sometimes used interchangeably, still they are different!

Liquidity Providers supply assets to the market, either directly (as in DEX liquidity pools) or through partnerships with exchanges and brokers. Their primary goal is to facilitate trading and earn spreads or fees.

Market Makers are specialized entities that continuously quote both buy and sell prices for specific assets, using their capital to profit from the bid-ask spread. They actively manage market risk and may have formal agreements with exchanges to ensure a liquid market.

Importance: Adequate market depth and trading volume are crucial for executing large orders without significant price impacts or slippage.

Evaluation: Look for providers that support high-volume trading pairs and demonstrate deep liquidity pools, with numerous buy and sell orders at various price levels.

Importance: A robust and reliable technological infrastructure ensures seamless connectivity, minimal downtime, and efficient trade execution.

Evaluation: Assess the provider's technology for low-latency connectivity, advanced algorithms, real-time market data, customizable charts, and redundant systems. Ensure they offer reliable APIs and integration tools.

Importance: Transparent and competitive pricing structures can significantly impact overall trading costs and profitability.

Evaluation: Compare spreads, commissions, and other transaction costs, seeking providers with fair and competitive pricing. Some may offer tiered pricing based on trading volume.

Importance: Operating under strict regulatory frameworks ensures adherence to industry standards, safeguarding the security and integrity of transactions.

Evaluation: Compare spreads, commissions, and other transaction costs, seeking providers with fair and competitive pricing. Some may offer tiered pricing based on trading volume.

The crypto market’s growth relies heavily on strong liquidity, and choosing the right provider can shape your trading success. Here’s a list of trusted liquidity providers leading the industry in 2025.

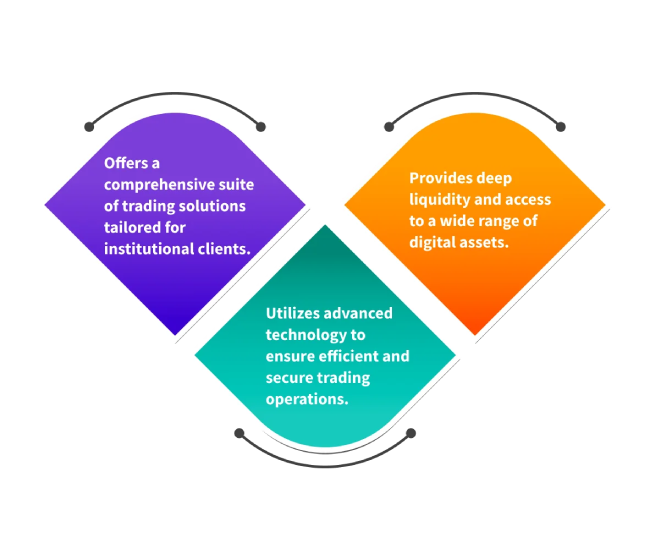

Galaxy Digital Trading is a premier financial services firm specializing in digital assets and blockchain technology.

They offer institutional-grade trading solutions, leveraging advanced infrastructure to provide deep liquidity and efficient market access.

Their comprehensive services cater to a wide range of digital assets, ensuring seamless trading experiences for institutional clients.

Key Features

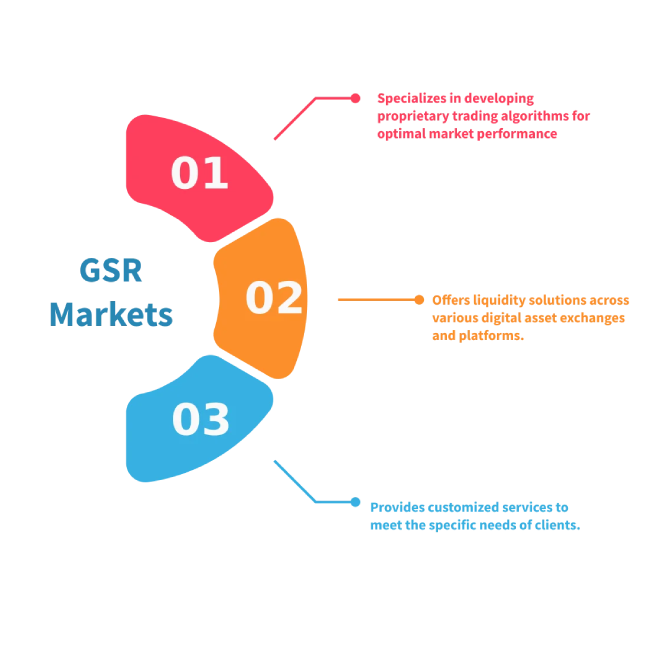

GSR Markets is a global leader in algorithmic trading and market-making for digital assets.

They provide customized liquidity solutions, utilizing proprietary trading algorithms to optimize market performance.

GSR's expertise ensures consistent liquidity provision across various digital asset exchanges and platforms.

Key Features

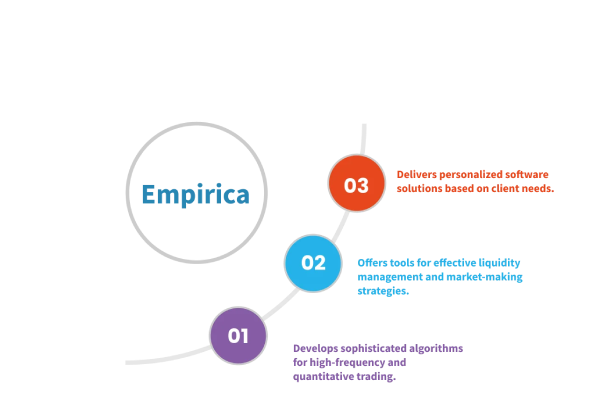

Empirica specializes in providing liquidity services for token projects across centralized and decentralized platforms.

Their advanced algorithms maintain tight spreads and deep order books, enhancing token performance and investor confidence.

Empirica's flexible business models and dynamic liquidity strategies have proven effective in increasing organic trading volumes and reducing price volatility.

Key Features

B2Broker offers multi-asset liquidity solutions, including cryptocurrencies, forex, and CFDs.

Their B2CONNECT platform provides fast access to liquidity pools on major crypto exchanges, supporting both taker and maker integrations.

B2Broker's comprehensive services include white-label solutions and advanced technological infrastructure for seamless trading operations.

Key Features

X Open Hub is a fintech company providing deep institutional liquidity across multiple asset classes, including cryptocurrencies.

They offer ultra-fast execution with low commissions and optimized spreads, ensuring efficient trading experiences.

X Open Hub's robust regulatory framework and advanced trading platforms support a wide range of financial instruments.

Key Features

Cumberland is another prominent market maker providing liquidity for digital assets.They offer over-the-counter trading services, facilitating large-volume transactions with significant market presence.

Despite facing regulatory challenges, Cumberland continues to play a vital role in enhancing liquidity across digital asset markets.

Key Features

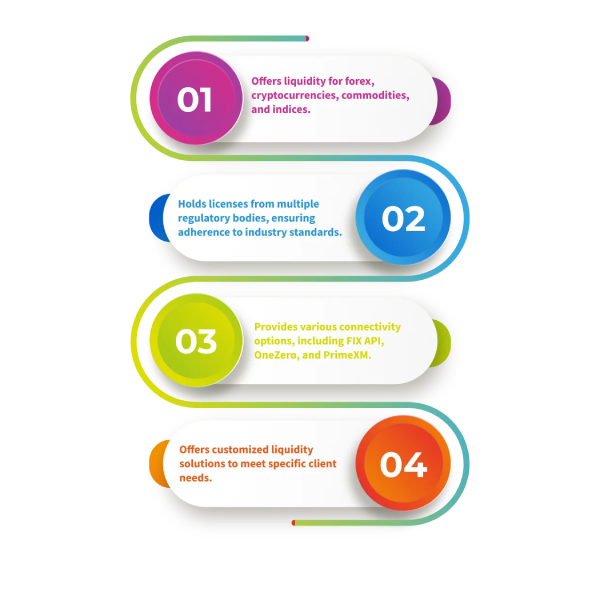

B2Prime is a regulated prime-of-prime multi-asset liquidity provider serving institutional clients.

They offer aggregated liquidity from top-tier providers, ensuring high-speed execution and competitive pricing.

B2Prime's services encompass a diverse range of assets, including forex, cryptocurrencies, commodities, and indices.

Key Features

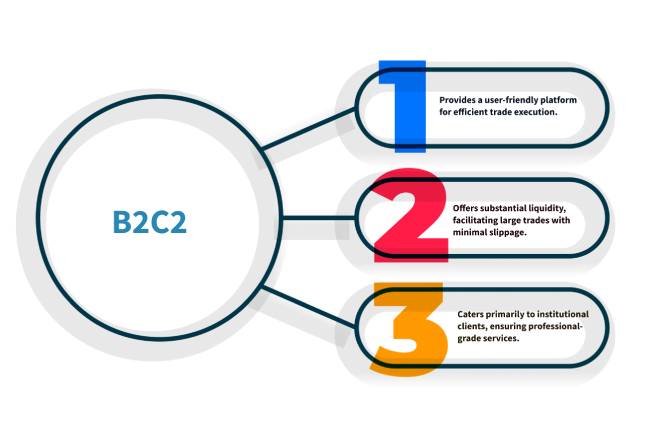

B2C2 is a leading electronic over-the-counter (OTC) liquidity provider in the crypto market.

They offer deep liquidity and efficient trade execution for a broad client base, including exchanges and institutional investors.B2C2's advanced trading infrastructure ensures seamless access to digital asset markets.

Key Features

Choosing the right liquidity provider is crucial for smooth, efficient, and secure trading operations. Here are key factors to consider before making your selection.

Define your trading goals, asset types, order size, and frequency. Consider whether you need spots, derivatives, deep liquidity, or diverse trading pairs to match your strategy.

The clearer your requirements, the easier it is to shortlist suitable providers. A well-matched liquidity partner can improve execution speed and reduce trading risks.

Make sure the liquidity provider’s systems integrate seamlessly with your existing platforms, whether it's MT4, MT5, FIX API, or proprietary solutions.Assess their reliability, uptime, execution speed, and the accuracy of their price feeds. A provider with advanced, stable infrastructure will reduce slippage and downtime, ensuring smooth trade execution.

Choosing the right tech partner can directly impact your trading performance and client satisfaction.

Research the provider’s track record, client reviews, and regulatory compliance.Choose one with proven stability, transparent operations, and a strong financial background.

Reliable, responsive support is essential, especially during market volatility or technical disruptions. A trustworthy partner reduces operational risks and strengthens long-term business growth.

Examine the provider’s fee schedule, including spreads, commissions, and any hidden costs.

Transparent and competitive pricing is essential for maximizing your profitability.Compare fee structures across providers and ensure you understand all associated costs before making a decision.

Choose a provider that adheres to relevant regulations and industry standards.Regulatory compliance helps ensure the safety of your funds and the integrity of the trading environment.

Look for information about the provider’s licenses, regulatory oversight, and security practices, such as encryption, two-factor authentication, and regular audits.

In today’s fast-paced crypto markets, choosing the right liquidity provider is crucial for ensuring smooth trading, minimizing costs, and maintaining market stability.

By carefully assessing factors like market depth, technology, fees, and reputation, traders and exchanges can find the best partner to meet their unique needs and thrive in an increasingly competitive landscape.

For seamless integration of liquidity solutions into your exchange, Fourchain offers end-to-end cryptocurrency exchange development services with advanced technology and global market access, empowering you to enhance trading efficiency and liquidity management.

Connect With Us Now

Drop us a line through the form below and we'll get back to you as soon as possible