Table of Content

Table of Content

Crypto futures trading allows traders to enter into a contract to buy or sell a crypto asset at a pre-determined price and on a future date. And it has contributed to the growth of crypto exchange trading volume, which has reached around $9.36 trillion in the first half of 2025 alone. For instance, Binance alone has registered $2.55 trillion in annual futures volume as of July 2025. This depicts the right time for crypto futures trading exchange development for entrepreneurs aspiring to launch one and enter the crypto space.

Crypto futures exchanges aren’t just those that allow users to lock the price of a crypto asset in the future, but they are also shaping the future of crypto trading. It comes with attractive components like leverage and hedging, which draw several investors to it!

In this blog, we will learn the following,

Let’s begin!

Crypto futures are a kind of contract where two parties agree to either buy or sell a cryptocurrency at a predetermined price and date in the future. This is opposite to that of spot trading, where you buy the asset instantly. Here, futures allow you to speculate on price movements without directly buying the asset.

For example, if a trader believes that Bitcoin will rise, then they will go “long” on futures, and if they expect the market to dip, then they will go “short”.

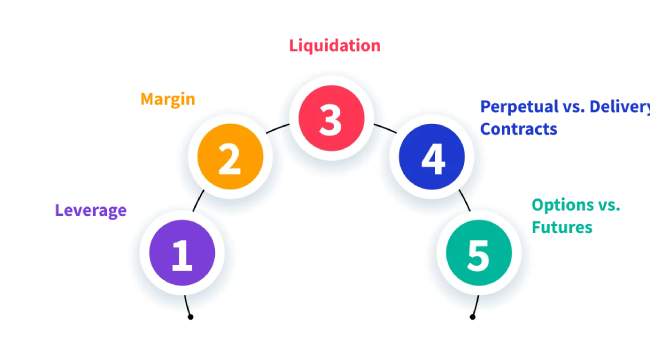

Leverage: Even if a user doesn’t have enough funds, they can still open a large position with the funds they have with the help of a leverage option. Say, for example, if an individual has $1,000 in his account, then he can select 10x leverage and open positions worth $10,000.

Margin: Traders need to deposit a minimum amount to open positions, which acts as collateral.

Liquidation: If the market moves against our positions, then the margin may be insufficient, and this can lead to forced liquidation.

Perpetual vs. Delivery Contracts: Delivery futures have an expiry date ( eg, 9th September 2025). But perpetual contracts don’t have an expiry date and are settled continuously through funding fees.

Options vs. Futures: Unlike options, where the users will just buy the right instead of an obligation, futures are binding contracts!

Crypto futures are no longer a new concept, as they have gained the required popularity. Because it enables hedging against price volatility and opens opportunities for high speculations. They also attract a wide range of institutional investors who need diverse tools to manage risks. According to a report published by CoinGlass, Bitcoin futures have reached a milestone of $30 billion in the first half of 2025. This clearly depicts its growth dominance in the crypto space!

Building a crypto futures exchange is not just about following the market trends. It is about making use of the high-growth business opportunity. Futures contracts have become the go-to choice among pro traders, who are constantly looking to make a profit. And that is the reason why most of the traders are going with futures more than spot trading. This shift depicts how much potential these derivatives platforms hold!

This is the most important factor, as it allows exchange owners to earn from various monetization methods, like,

Traders, especially experienced ones, prefer futures for hedging and speculation purposes. Offering these products can help exchanges in capturing and retaining their users.

Rather than regular exchanges that just offer spot trading, exchange owners can expand beyond it by diversifying their offerings. And this also gives a competitive edge in a crowded market. Where advanced features like futures set the exchange platform apart! And help attract a larger number of traders.

Crypto futures trading exchange offers both financial rewards as well as a top position in the market for the platform owners. Thus, making it one of the compelling business ventures in the crypto landscape!

Launching a successful crypto futures trading exchange requires several key features that offer the required performance for the exchange. Have a look at the must-have features listed below,

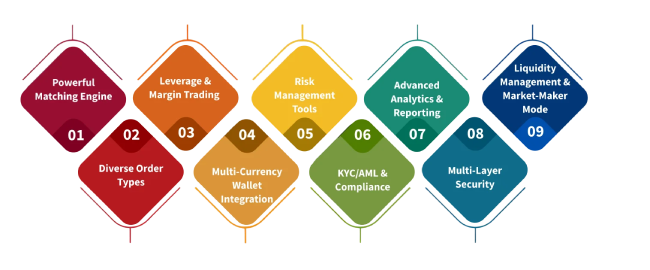

The matching engine is the most crucial aspect of any exchange. It is responsible for processing thousands of transactions per second. It helps in matching the buy and sell orders in real time and ensures traders are offered a smooth user experience.

Pro traders often expect flexibility, beyond the basic trading modules. Futures platform must support advanced order types like,

As already mentioned, leverage is one of the most attractive aspects of futures trading. Exchanges must provide leverage options in various degrees, such as 2x-125x, along with margin management tools.

Users should be easily able to deposit, withdraw, and manage multiple crypto assets seamlessly. This integration offers users both convenience and security.

This is extremely important for mitigating risks. Insurance funds and other fund management alerts help users to safeguard their funds from risks.

Adhering to regulations and compliance is something that can’t be taken lightly. So, integrating strong KYC/AML procedures is crucial to verifying the identities of users effectively. This helps in minimizing fraud and data theft.

Traders require proper insights about the market, as this helps them stay aware of the real-time profit and loss and other market trends. Thus, an intuitive dashboard to view these metrics is vital to offer both transparency as well as a first-class user experience.

Security breaches are highly harmful! So, make sure to have strong security measures in the exchange platform, like,

Liquidity is like the fuel that helps in running the exchange smoothly. With the help of external liquidity providers through APIs, ensure smooth order execution in the platform without much delay!

Building a crypto futures trading exchange requires proper planning and execution. Here is a step-by-step roadmap to help you get started!

Start with in-depth research on your target market and analyze your competitors closely. And then define what kind of users you want to serve, whether retail traders or investors, or both! Upon deciding on your targeted niche, proceed to jot down the features that you wish to have in your platform.

First, decide your regions of operation and then go through their jurisdiction and obtain the required licenses. This helps you comply with the regulations right from day one. This effectively reduces the legal risks and builds transparency among traders.

The exchange’s architecture must be scalable, and the design should be user-friendly. And it should be easy for both beginners as well as professional traders to navigate the platform with ease.

Here, the important features and components of the platform are built, which consist of,

Security is a must in exchange due to the involvement of money. Try to integrate strong security measures in your exchange, like,

This helps in safeguarding users' funds and data and offers them a secure trading environment.

Upon completion of the development and integration phase, it is time for testing. So, run rigorous testing to check its performance and efficiency. This helps you find out bugs in the initial phase itself and fix them before they hit the end users.

Once done with testing, your platform is all set for launch. But it is advised to launch the platform in stages rather than going live all at once. This helps you resolve issues that come even after deployment and fix them before full-scale adoption.

Your work doesn’t end with just launching the platform. You need to monitor the performance of your exchange platform after launch, and then offer the required support and maintenance. This ensures that the issues are resolved quickly and enhances trust among users.

When it comes to developing a crypto derivatives exchange, choosing the right development partner is equally important, as it can make or break your development journey. At Fourchain, we prioritize security at the first hand, as it is crucial to earn the trust of users, along with high scalability that ensures the platform can grow as your business grows without facing any downtime!

What Sets Fourchain Apart?

Connect With Us Now

Drop us a line through the form below and we'll get back to you as soon as possible