Table of Content

- Services

- Blockchain

- Solutions

Exchange Development

Banking & Fintech

Wallet

Trading Bots

DEFI

NFT

Game Development

- Blog

- Company

- Get in Touch

Table of Content

Portfolio management softwares are crucial these days because people are finding it difficult to keep track of all their investments, like stocks, crypto, and real estate. Because managing these in one place is challenging. And that’s where Portfolio management softwares have stepped in to make things easier. They offer users the required insights, performance metrics, and much more.

Do you know?

According to a report released by Grand View Research, the global wealth management software market is said to reach $12.07 billion by the year 2030. This tremendous growth is due to the increasing demand for modern tools to manage digital finance.

For businesses planning to launch a portfolio management software is a smart move, as the market is booming like anything.

In this blog, you will learn the following,

Let us get started!

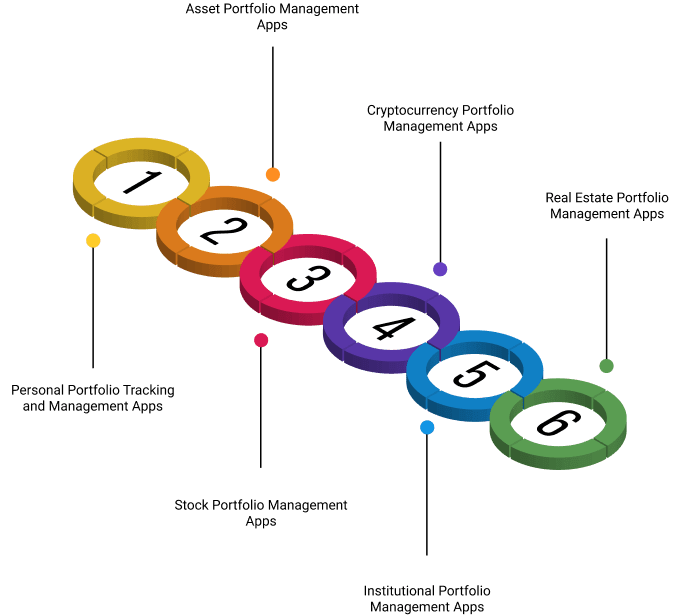

Portfolio management softwares are of different types, and they vary depending on what kind of assets they handle.

This is for everyday investors who want to see all their investments under a single roof, like,

These apps are very simple and easy to use, and offer users clear charts and insights.

Examples include: Mint and Personal Capital.

This is suitable for people who own different types of assets, like

These apps help them track their asset value over a period of time, and suggest to them the next action they can take with these assets, whether to sell or hold!

Examples include: Asset Panda, Sortly.

This is specifically made for people who invest in the stock market. They are shown with live stock prices, and allow them to buy and sell shares easily from the app itself.

Examples include: Robinhood, E*TRADE.

These apps are used for tracking cryptocurrencies like Bitcoin and Ethereum. They connect to crypto exchanges, through which users are shown real-time prices, and they can learn about their profit and loss.

Examples include: CoinStats, Delta.

These apps are used by banks, investment firms, and wealth managers of high-net-worth individuals. They handle many client portfolios on a single dashboard. And they are offered detailed reports and financial regulations.

Examples include: Morningstar Direct.

This is exclusively for property owners and investors, through which they can track rental income, expenses, and other property values. And some users even try predicting future prices of those assets using the market data.

Examples include: Property Matrix, Buildium

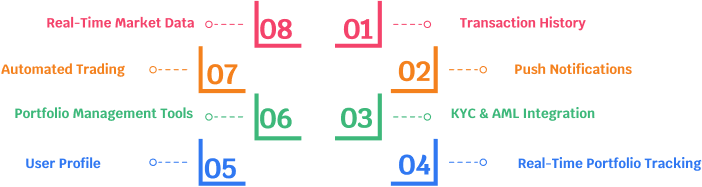

A good portfolio management software should display more than just a list of assets. It should help users in making the right investment decision! Let us view the key features,

It showcases the latest value of users’ investments instantly. This is crucial because market prices tend to change now and then, and users want the most accurate price. Say, for example, if a stock price drops by 5% then the user sees it immediately and can decide whether to sell it right now or wait for some more time.

KYC and AML compilation keep the app safe from illegal and fraudulent activities. This involves cross-checking and verifying the users’ identity before allowing them to manage assets.

With push notifications, users can stay updated with instant alerts about various things like,

For example, it will pop up like, “Your Bitcoin price has increased by 8% today!”

All the records of buying, selling, and withdrawals are effectively recorded. This makes it simple for users to view their past transactions and use them for record-keeping purposes.

Here, users can store their details and select their investment preferences. For instance, they can select “tech stocks” as a preferred category, and the app will show updates relevant to it.

Users can organize investments into various categories and can view how each group is performing, like,

Users can set up rules to buy or sell automatically. So, they need not check the app manually every time. For example, they can set something like, “Sell Ethereum if its price drops below $2,000”

The app offers up-to-date charts along with price feeds and latest news to users to help them make better decisions. So, here they can act upon facts and avoid guesswork. For example, they can view the live price of any cryptocurrency before deciding to invest in it!

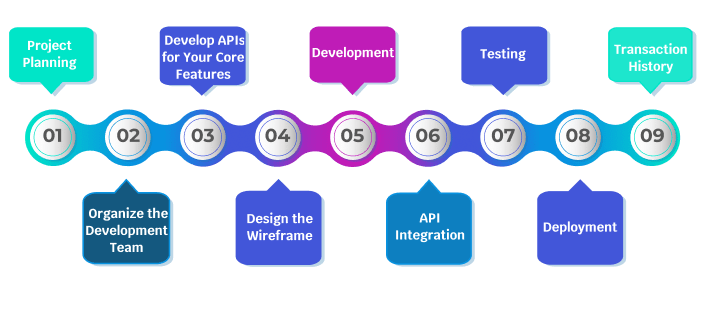

Developing a portfolio management software requires careful planning and execution. Here is a step-by-step guide for developing one.

The first thing you need to do before starting development is to have a clear idea of what you want the app to do and who your target audience is. And decide whether you are building it for everyday investors or large institutions like banks. It is better to decide on all these things before proceeding further. Try analyzing existing players in the market, as this helps you in identifying the gaps left by them. So that you can fill those market gaps effectively with your “unique selling point”.

Plan a clear budget along with a project timeline. And decide on the tech stack you are going to opt for, and what development methodology you are going to choose. Having a proper plan helps you avoid delays and additional costs during development.

You will need a skilled team with hands-on experience to deliver a successful portfolio management software. Here is a list,

APIs are like a connecting bridge that seamlessly connects your app to the live data. For example, you will need APIs to extract real-time market data from various platforms. Thus, offering your users what they need.

A wireframe is like the skeleton of your app. It depicts what each screen will look like and how users will navigate through it. This ensures everyone gets a clear picture and understands the flow before the actual development process.

This is the step where real coding takes place. The developers create both the app’s frontend and backend systems. The utmost goal is not only to make the platform fast but also easy to navigate for the users.

This step involves connecting the APIs you have prepared earlier to bring life to your features. And it offers the major things like,

The app must undergo rigorous testing to identify bugs and other issues. This helps you to resolve bugs in the initial stage itself, so that it reaches users as a properly functioning app without any performance issues.

Pro tip: Try conducting the testing on different devices and at different internet speeds to make sure it works well!

Once done with testing, it is time to launch the app publicly in app stores. And your work doesn’t end with just launching your app. You need to make plans for updates and maintenance to ensure your app stays competitive.

The cost of developing a portfolio management software typically ranges between $9,500 to $18,000. And it varies based on several factors like,

Building a portfolio management software allows you to generate income in several ways.

As an admin, you can charge users a monthly or yearly fee to access various things like,

You can offer expert financial advice or other optimization services at a fee. You can do this either in-app or through sessions. This will act as a prominent source of income.

To educate beginner investors or those who don’t have enough knowledge on portfolio management, you can try offering educational insights that help them improve their investment skills. Such as,

Portfolio management softwares have become a go-to tool among investors of all levels, as their main focus is to have a reliable platform where they can manage their assets without much difficulty. Building a Portfolio management software requires a clear-cut idea, a proper feature list, and a solid development plan. With the right approach and execution, you can create a successful portfolio management software and start generating revenue. In case you are interested in launching your Portfolio management software, then connect with Fourchain, a leading fintech app development company. That helps you turn your ideas into reality!

Connect With Us Now

Drop us a line through the form below and we'll get back to you as soon as possible