Table of Content

- Services

- Blockchain

- Solutions

Exchange Development

Banking & Fintech

Wallet

Trading Bots

DEFI

NFT

Game Development

- Blog

- Company

- Get in Touch

Table of Content

In the ever-evolving world of cryptocurrency trading, an exchange's success depends on the efficiency and reliability of its trading engine.

This critical component serves as the heart of any crypto exchange and is responsible for matching buy and sell orders, executing trades, and maintaining the order book in real time.

A robust trading engine is the backbone of any crypto exchange. As a trusted cryptocurrency exchange development company fourchain ensures high-performance engines that process orders with low latency and maximum reliability.

For entrepreneurs and startups venturing into the crypto exchange space, understanding the importance of trading engines and knowing how to choose the right one is a must!

This knowledge can make the difference between a thriving, competitive platform and one that struggles to meet user demands.

As we delve deeper into the intricacies of trading engines, their key features, and selection criteria, readers will gain valuable insights that can guide them in making informed decisions for their crypto exchange ventures.

A trading engine in a crypto exchange is a core software system responsible for matching buy and sell orders and executing trades in real time.

It processes order details like type and price, identifies matches, and updates the order book to maintain market transparency and liquidity.

Beyond matching, it handles tasks such as order cancellations, user authentication, and security protocols to guard against threats like unauthorized access or DDoS attacks.

Designed for high-speed performance, a trading engine can process thousands of transactions per second, ensuring efficient, fair, and reliable trading in the fast-paced world of cryptocurrency.

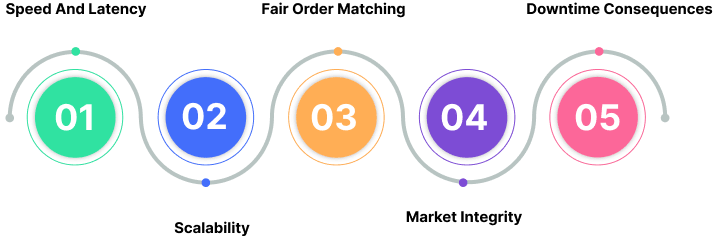

The trading engine is a critical component of a crypto exchange, impacting both the user experience and the exchange's overall success.

Its importance can be understood through several key factors that highlight its role in maintaining efficient, fair, and secure trading environments.

A trading engine with low latency ensures rapid execution of orders, enabling traders to seize opportunities before market conditions change.

This speed is crucial for high-frequency trading strategies where milliseconds can determine profits or losses.

Low latency also enhances user satisfaction by providing real-time feedback on trades.

Scalable trading engines handle increasing transaction volumes and user activity without compromising performance.

This capability is essential during peak market periods when demand surges, ensuring that the system remains stable and responsive.

Scalability helps exchanges maintain their competitive edge by supporting growth without interruptions.

Trading engines use algorithms to match buy and sell orders based on time and price priorities, ensuring equitable execution.

This fairness fosters trust among traders by maintaining transparency and preventing favoritism. Fair order matching is crucial for maintaining market integrity and encouraging participation.

A robust trading engine helps uphold market integrity by preventing manipulation and ensuring accurate execution of trades.

It contributes to a secure and reliable trading environment, which is vital for attracting and retaining users. By maintaining market integrity, exchanges can build a reputation for trustworthiness.

Any downtime in the trading engine can lead to missed opportunities, financial losses, and damaged user trust.

Continuous operation is essential for maintaining the exchange’s reputation and competitiveness. Downtime can also result in regulatory scrutiny and potential legal issues if not addressed promptly.

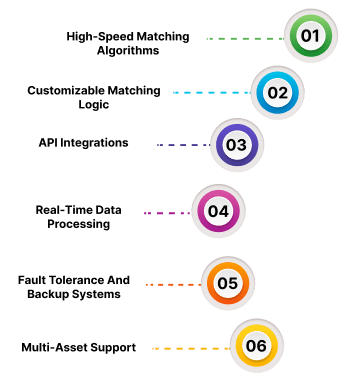

A powerful trading engine is the backbone of a successful crypto exchange, ensuring seamless trade execution and enhancing user experience.

Below are the key features that define its functionality and reliability.

High-speed matching algorithms process buy and sell orders within milliseconds, ensuring rapid trade execution.

This speed is critical in volatile crypto markets where price fluctuations occur in seconds. Efficient algorithms enhance user satisfaction by minimizing delays.

Customizable matching logic allows exchanges to define specific rules for order matching, such as FIFO (First In, First Out) or Pro-Rata.

This flexibility caters to diverse market needs and trading strategies. It ensures fairness while adapting to unique trading environments.

API integrations enable seamless interaction between the trading engine and third-party applications like trading bots or analytics tools.

They support automated trading, real-time data access, and account management. Comprehensive APIs enhance the exchange’s ecosystem and usability.

Real-time data processing ensures that the order book, market depth, and price information are constantly updated.

This provides traders with accurate, up-to-date market insights. It also allows for immediate feedback on trades and order statuses.

Fault tolerance and backup systems ensure high availability and reliability of the trading engine.

Features like data replication, failover mechanisms, and disaster recovery protect against downtime or data loss. This safeguards user trust and exchange operations.

Multi-asset support allows the trading engine to handle various cryptocurrencies, tokens, and even traditional assets.

This feature enables diverse trading pairs and cross-asset transactions. It ensures scalability as new assets are introduced into the market.

When selecting a trading engine for your cryptocurrency exchange, several key factors should be considered to ensure optimal performance, security, and user satisfaction.

Here's a detailed look at the crucial aspects to evaluate before choosing a trading engine for your exchange.

Performance metrics are critical indicators of a trading engine's efficiency and speed.

These include order execution time, which should be measured in milliseconds, and the ability to handle high volumes of trades simultaneously.

A top-tier trading engine should demonstrate low latency, processing thousands of orders per second to meet the demands of high-frequency trading and volatile market conditions.

The ability to customize the trading engine is essential for tailoring it to your exchange's specific needs.

This includes flexibility in order matching algorithms, support for various order types, and the capacity to add new trading pairs or assets.

A highly customizable engine allows you to differentiate your exchange and adapt to evolving market trends and user preferences.

A trading engine should seamlessly integrate with other components of your exchange, such as payment gateways, KYC/AML modules, and wallet systems.

Look for engines that offer robust APIs and comprehensive documentation to facilitate smooth integration with existing systems and third-party services.This ensures efficient operations and reduces development time and costs.

The security of a trading engine is paramount in protecting user funds and maintaining trust.

Evaluate the engine's built-in security features, including DDoS protection, encryption protocols, and access controls.

A robust security architecture should also include regular security audits and penetration testing to identify and address potential vulnerabilities.

Consider the reputation and track record of the trading engine provider. Look for engines used by established exchanges and those with positive reviews from industry experts.

A reputable provider should offer reliable customer support, regular updates, and a strong commitment to maintaining and improving their product.

Choose a trading engine that can scale with your exchange's growth. It should handle increasing user numbers and trading volumes without performance degradation.

Additionally, the engine should be designed to accommodate future technological advancements and regulatory changes in the crypto industry. This ensures your exchange remains competitive and compliant in the long term.

By carefully evaluating these factors, you can select a trading engine that not only meets your current needs but also positions your exchange for future success in the dynamic cryptocurrency market.

At Fourchain, we deliver end-to-end crypto exchange development services with high-performance trading engines and advanced security.

Our future-ready tech stack ensures seamless integration and scalability, thus helping you stay competitive and market-ready.

When deciding whether to build a trading engine in-house or integrate a third-party solution, both options come with distinct advantages and drawbacks.

Here's a concise breakdown of the pros and cons of each approach,

Pros

Cons

Pros

Cons

The choice between building or buying depends on your exchange's resources, timeline, and strategic goals.

Building in-house is ideal for those seeking customization and control but requires significant investment.

Third-party integration is better suited for quick deployment and cost efficiency but may limit personalization.

So, the choice is yours, choose accordingly!

A trading engine is like the locomotive of a train , it powers the entire system, pulling everything forward with precision, speed, and reliability. Without it, the exchange can’t move, grow, or deliver the seamless experience that today’s traders expect.

Businesses aiming to launch a secure and fast exchange platform can benefit from our specialized cryptocurrency exchange development services designed for speed, scalability, and compliance.

Whether you're building from the ground up or upgrading your current platform, our experts are here to help you drive performance, scalability, and trust.

Let’s put the right engine behind your exchange and keep it moving full steam ahead!

Connect With Us Now

Drop us a line through the form below and we'll get back to you as soon as possible